Economics 401 – Answers to Problems from Chapter 9

- Real Estate And Money Supply - Management Study Guide

- Money Supply Definition - Investopedia.com

- Money Supply And Demand And Nominal Interest Rates

n Answers to Textbook Problems

Review Questions

1. The position of the FE line is determined by the labor market and the production function. Labor supply and demand determine equilibrium employment. Using equilibrium employment in the production function gives the full-employment level of output. The FE line is vertical at that point. The FE line shifts to the right if there is an increase in labor supply or the capital stock or if there is a beneficial supply shock.

2. The IS curve shows combinations of the real interest rate (r) and output (Y) that leave the goods market in equilibrium. Equilibrium in the goods market occurs when the aggregate supply of goods (Y) equals the aggregate demand for goods (Cd + Id + G). Since desired national saving (Sd) is Y – Cd – G, an equivalent condition is Sd = Id. Equilibrium is achieved by the adjustment of the real interest rate to make the desired level of saving equal to the desired level of investment. For different levels of output, there are different desired saving curves, with different equilibrium interest rates. When plotted on a figure showing output and the real interest rate, this forms the IS curve, as shown in Figure 9.15. The curve slopes downward because as output rises, the saving curve shifts along the investment curve and the real interest rate declines.

Figure 9.15

The IS curve could shift down and to the left if: (1) expected future output falls, because this increases desired saving; (2) government purchases fall, because this increases desired saving; (3) the expected future marginal product of capital falls, because this decreases desired investment; or (4) corporate taxes increase, because this decreases desired investment.

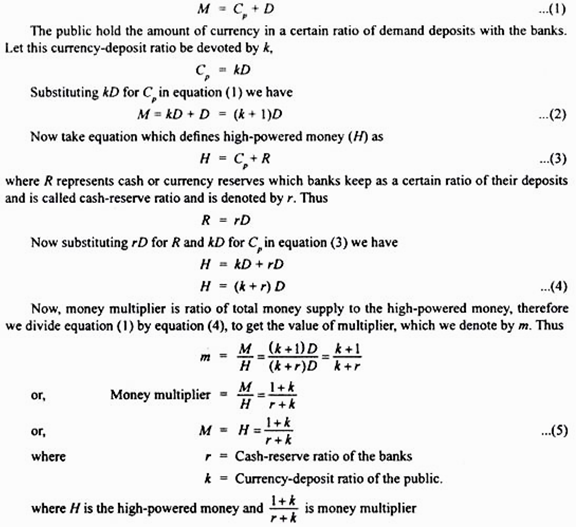

3. The LM curve shows the combinations of output and the real interest rate that maintain equilibrium in the asset market. Equilibrium in the asset market occurs when real money demand equals the real money supply.

Figure 9.16 shows the derivation of the LM curve and why it slopes upward. An increase in output from Y1 to Y2 raises money demand, shifting the money demand curve from MD(Y1) to MD(Y2). With money supply fixed at MS, there must be a higher real interest rate to get equilibrium in the asset market. This gives two points of the LM curve, plotted on the right half of the figure. The result is that higher output increases the real interest rate along the LM curve, so the LM curve slopes upward.

Figure 9.16

The LM curve would shift down and to the right if the nominal money supply or expected inflation increased or if the price level or nominal interest rate on money decreased. In addition, the curve would shift down and to the right if there were a decrease in wealth, a decrease in the risk of alternative assets relative to the risk of holding money, an increase in the liquidity of alternative assets, or an increase in the efficiency of payment technologies.

4. For constant output, if real money supply exceeds the real quantity of money demanded, the real interest rate will decline to increase the real quantity of money demanded until equilibrium is reached. This process occurs because people who find themselves with excess money balances purchase nonmonetary assets, thus increasing the market price of the nonmonetary assets and reducing the real interest rate.

Also known as the Hicks-Hansen model, the IS-LM curve is a macroeconomic tool used to show how interest rates and real economic output relate. IS refers to Investment-Saving while LM refers to Liquidity preference-Money supply. These curves are used to model the general equilibrium and have been given two equivalent interpretations. Conversely, if the Fed wants to decrease the money supply, it sells bonds from its account, thus taking in cash and removing money from the economic system. Adjusting the federal funds rate is a.

5. General equilibrium is a situation in which all markets in an economy are simultaneously in equilibrium. This is shown in Figure 9.17 as the point at which the FE line and the IS and LM curves intersect. If the economy is not initially in general equilibrium, output and the real interest rate are determined by the intersection of the IS and LM curves. Then adjustment of the price level moves the LM curve until it intersects the FE line and IS curve.

Figure 9.17

6. There is monetary neutrality if a change in the nominal money supply changes the price level but has no effect on real variables. Once prices adjust, money is neutral in the IS–LM model, because a change in the money supply that shifts the LM curve is matched by a proportional change in the price level that returns the real money supply back to its original level and moves the LM curve back to its original location. Classical economists believe that money is neutral in the short run, but Keynesians believe that there may be sluggish adjustment of the price level, so that changes in the money supply affect output and the real interest rate in the short run. Both classicals and Keynesians believe money is neutral in the long run.

7. The aggregate demand curve relates the price level to the aggregate demand for goods and services. It is downward sloping, because with a fixed nominal money supply, an increase in the price level shifts the LM curve up, so the level of output at the IS-LM intersection is lower.

Factors that shift the aggregate demand curve up and to the right include (1) an increase in expected future output, which reduces desired saving, raises desired consumption, and shifts the IS curve up and to the right; (2) an increase in government purchases, which reduces desired saving and shifts the IS curve up and to the right; (3) an increase in expected future MPK, which increases desired investment and shifts the IS curve up and to the right; (4) a decrease in corporate taxes, which increases desired investment and shifts the IS curve up and to the right; (5) an increase in the nominal money supply, which raises the real money supply and shifts the LM curve down and to the right;

(6) a decrease in the interest rate on money, which decreases the demand for money and shifts the

LM curve down and to the right; and (7) an increase in the expected inflation rate, which reduces the demand for money and shifts the LM curve down and to the right.

8. The short-run aggregate supply curve is horizontal and the long-run aggregate supply curve is vertical. The short-run aggregate supply curve is horizontal because prices remain fixed in the short run. The long-run aggregate supply curve is vertical because the aggregate amount of output supplied is the full-employment level, regardless of the price level.

9. In the short run, money is not neutral, but in the long run it is neutral. Suppose the economy is initially in general equilibrium, as shown in Figure 9.18, where LRAS, SRAS1, and AD1 intersect.

Now suppose the money supply declines by 10%, so the aggregate demand curve shifts down and to the left to AD2. In the short run, the equilibrium occurs at the intersection of AD2 and SRAS1, so output declines and the price level is unchanged. Since output declines, money is not neutral. In the long run, however, the price level will decline so the short-run aggregate supply curve shifts down to SRAS2. The long-run equilibrium occurs at the intersection of AD2, SRAS2, and LRAS, at which output has been restored to its original level and the price level is lower. Since output is back at its original level in the long run, money is neutral in the long run.

Figure 9.18

Numerical Problems

1. (a) Sd = Y – Cd – G

= Y – (4000 – 4000r + 0.2Y) – 2000

= –6000 + 4000r + 0.8Y.

(b) (1) Using the equation that goods supplied equals goods demanded gives

Y = Cd + Id + G

= (4000 – 4000r + 0.2Y) + (2400 – 4000r) + 2000

= 8400 – 8000r + 0.2Y.

So 0.8Y = 8400 – 8000r, or

8000r = 8400 – 0.8Y.

(2) Using the equivalent equation that desired saving equals desired investment gives

Sd = Id

–6000 + 4000r + 0.8Y = 2400 – 4000r

0.8Y = 8400 – 8000r, or

8000r = 8400 – 0.8Y.

Real Estate And Money Supply - Management Study Guide

So we can use either equilibrium condition to get the same result.

When Y = 10,000,

8000r = 8400 – (0.8 × 10,000) = 400,

so r = 0.05.

When Y = 10,200,

8000r = 8400 – (0.8 × 10,200) = 240,

so r = .03.

(c) When G = 2400, desired saving becomes Sd = –6400 + 4000r + 0.8Y. Sd is now 400 less for any given r and Y.

Setting Sd = Id, we get

–6400 + 4000r + 0.8Y = 2400 – 4000r

8000r = 8800 – 0.8Y.

Similarly, using the equation that goods supplied equals goods demanded gives:

Y = Cd + Id + G

= (4000 – 4000r + 0.2Y) + (2400 – 4000r) + 2400

= 8800 – 8000r + 0.2Y.

So 0.8Y = 8800 – 8000r, or

8000r = 8800 – 0.8Y.

At Y = 10,000, this is 8000r = 8800 – (0.8 × 10,000) = 800, so r = 0.10. The market-clearing real interest rate increases from 0.05 to 0.10. Thus the IS curve shifts up and to the right from IS1 to IS2 in Figure 9.19.

Figure 9.19

2. (a) Md/P = 3000 + 0.1Y – 10,000i

= 3000 + 0.1Y – 10,000(r + pe)

= 3000 + 0.1Y – 10,000(r + .02)

= 2800 + 0.1Y – 10,000r.

Setting M/P = Md/P:

6000/2 = 2800 + 0.1Y – 10,000r

10,000r = –200 + 0.1Y

r = –0.02 + (Y/100,000).

When Y = 8000, r = 0.06.

When Y = 9000, r = 0.07.

These points are plotted as line LMa in Figure 9.20.

Figure 9.20

(b) M = 6600, so M/P = 3300. Setting money supply equal to money demand:

3300 = 2800 + 0.1Y – 10,000r

10,000r = –500 + 0.1Y

r = –0.05 + (Y/100,000).

When Y = 8000, r = 0.03.

When Y = 9000, r = 0.04.

The LM curve is shifted down and to the right from LMa to LMb in Figure 9.20, since the same level of Y gives a lower r at equilibrium.

(c) Md/P = 3000 + 0.1Y – 10,000(r + pe)

= 3000 + 0.1Y – 10,000r – (10,000 ´ .03)

= 2700 + 0.1Y – 10,000r.

Setting money supply equal to money demand:

3000 = 2700 + 0.1Y – 10,000r

10,000r = – 300 + 0.1Y

r = – 0.03 + (Y/100,000).

When Y = 8000, r = 0.05.

When Y = 9000, r = 0.06.

The LM curve is shifted down and to the right from LMa to LMc in Figure 9.20, since there is a higher real interest rate for every given level of output. The LM curve shifts down and to the right by one percentage point (the increase in pe) because for any given Y, the same nominal interest rate clears the asset market. With an unchanged nominal interest rate, the increase in pe is matched by an equal decrease in r.

3. (a) First, we’ll find the IS curve.

Sd = Y – Cd – G = Y – [200 + 0.8(Y – T) – 500r] – G = Y – [200 + (0.6Y – 16) – 500r] – G

= –184 + 0.4Y + 500r – G

Setting Sd = Id gives –184 + 0.4Y + 500r – G = 200 – 500r.

Solving this for Y in terms of r gives Y = (960 + 2.5G) – 2500r.

When G = 196, this is Y = 1450 – 2500r.

Next, we’ll find the LM curve. Setting money demand equal to money supply gives 9890/P = 0.5Y – 250r – 25, which can be solved for Y = 19,780/P + 50 + 500 r.

With full-employment output of 1000, using this in the IS curve and solving for r gives r = 0.18.

Using Y = 1000 and r = 0.18 in the LM curve and solving for P gives P = 23. Plugging these results into the consumption and investment equations gives C = 694 and I = 110.

(b) With G = 216, the IS curve becomes Y = 1500 – 2500r. With Y = 1000, the IS curve gives r = .20, the LM curve gives P = 23.27, the consumption equation gives C = 684, and the investment equation gives I = 100.

4. (a) First, look at labor market equilibrium.

Labor supply is NS = 55 + 10(1 – t)w. Labor demand (ND) comes from the equation w = 5A – (0.005A ´ ND). Substituting the latter equation into the former, and equating labor supply and labor demand gives N = 100. Using this in either the labor supply or labor demand equation then gives w = 9. Using N in the production function gives Y = 950.

(b) Next, look at goods market equilibrium and the IS curve.

Sd = Y – Cd – G = Y – [300 + 0.8(Y – T) – 200r] – G = Y – [300 + (0.4Y – 16) – 200r] – G

= – 284 + 0.6Y + 200r – G.

Setting Sd = Id gives – 284 + 0.6Y + 200r – G = 258.5 – 250r.

Solving this for r in terms of Y gives r = (542.5 + G)/450 – 0.004/3Y.

When G = 50, this is r = 1.317 – 0.004/3 Y.

With full-employment output of 950, using this in the IS curve and solving for r gives r = 0.05. Plugging these results into the consumption and investment equations gives C = 654 and I = 246.

(c) Next, look at asset market equilibrium and the LM curve.

Setting money demand equal to money supply gives 9150/P = 0.5Y – 250(r + 0.02), which can be solved for r = [0.5Y – (5 + 9150/P)]/250. With Y = 950 and r = 0.05, solving for P gives P = 20.

(d) With G = 72.5, the IS curve becomes r = 1.367 – 0.004/3 Y. With Y = 950, the IS curve gives r = .10, the LM curve gives P = 20.56, the consumption equation gives C = 644, and the investment equation gives I = 233.5. The real wage, employment, and output are unaffected by the change.

5. The IS curve is found by setting desired saving equal to desired investment. Desired saving is Sd =

Y – Cd – G = Y – [1275 + 0.5(Y –T) – 200r] – G. Setting Sd = Id gives Y – [1275 + 0.5(Y – T) –

200r] – G = 900 –200r, or Y = 4350 – 800r + 2G – T. The LM curve is M/P = L = 0.5Y – 200i = 0.5Y – 200(r + p) = 0.5Y – 200r.

(a) T = G = 450, M = 9000. The IS curve gives Y = 4350 – 800r + 2G – T = 4350 – 800r + (2 ´ 450) –450 = 4800 – 800r. The LM curve gives 9000/P = 0.5Y – 200r. To find the aggregate demand curve, eliminate r in the two equations by multiplying the LM curve through by 4 and rearrange the resulting equation and the IS curve.

LM: 9000/P = 0.5Y – 200r. Multiplying by 4 gives 36,000/P = 2Y – 800r. Rearranging gives

800r = 2Y – 36,000/P. IS: Y = 4800 – 800r. Rearranging gives 800r = 4800 – Y. Setting the right-hand sides of these two equations to each other (since both equal 800r) gives: 2Y – (36,000/P) = 4800 – Y, or 3Y = 4800 + (36,000/P), or Y = 1600 + (12,000/P); this is the AD curve.

With Y = 4600 at full employment, the AD curve gives 4600 = 1600 + (12,000/P), or P = 4. From the IS curve Y = 4800 – 800r, so 4600 = 4800 – 800r, or 800r = 200, so r = 0.25. Consumption is C = 1275 + 0.5(Y – T) – 200r = 1275 + 0.5(4600 – 450) – (200 × 0.25) = 3300. Investment is I = 900 – 200r = 900 – (200 × 0.25) = 850.

(b) Following the same steps as above, with M = 4500 instead of 9000, gives the aggregate demand curve AD: Y = 1600 + (6000/P). With Y = 4600, this gives P = 2. Nothing has changed in the IS equation, so it still gives r = 0.25. And nothing has changed in either the consumption or investment equations, so we still get C = 3300 and I = 850. Money is neutral here, as no real variables are affected and the price level changes in proportion to the money supply.

(c) T = G = 330, M = 9000. The IS curve is Y = 4350 – 800r + 2G – T = 4350 – 800r + (2 ´ 330) – 330 = 4680 – 800r.

LM: 36,000/P = 2Y – 800r, or 800r = 2Y – 36,000/P.

IS: Y = 4680 – 800r, or 800r = 4680 – Y.

AD: 2Y – (36,000/P) = 4680 – Y, or (36,000/P) + 4680 = 3Y, or Y = 1560 + (12,000/P).

With Y = 4600 at full employment, the AD curve gives 4600 = 1560 + (12,000/P), or P = 3.95. From the IS curve, Y = 4680 – 800r, so 4600 = 4680 – 800r, or 800r = 80, so r = 0.10. Consumption is C = 1275 + 0.5(Y – T) – 200r = 1275 + 0.5(4600 – 330) – (200 ´ 0.10) = 3390. Investment is I = 900 – 200r = 900 – (200 ´ 0.10) = 880.

6. (a) A = 2, f1 = 5, f2 = 0.005, n0 = 55, nw = 10, c0 = 300, cY = 0.8, cr = 200, t0 = 20, t = 0.5, i0 = 258.5,

ir = 250, l0 = 0, lY = 0.5, lr = 250.

(b) These values are all calculated directly, using the equations in the Appendix. They should match the results in Numerical Problem 4, above.

(c) See the answer to part b.

Analytical Problems

1. (a) The increase in desired investment shifts the IS curve up and to the right, as shown in Figure 9.21. The price level rises, shifting the LM curve up and to the left to restore equilibrium. Since the real interest rate rises, consumption declines. In summary, there is no change in the real wage, employment, or output; there is a rise in the real interest rate, the price level, and investment; and there is a decline in consumption.

Figure 9.21

(b) The rise in expected inflation shifts the LM curve down and to the right, as shown in Figure 9.22. The price level rises, shifting the LM curve up and to the left to restore equilibrium. Since the real interest rate is unchanged, consumption and investment are unchanged. In summary, there is no change in the real wage, employment, output, the real interest rate, consumption, or investment; and there is a rise in the price level.

Figure 9.22

(c) The increase in labor supply is shown as a shift in the labor supply curve in Figure 9.23 (a).

This leads to a decline in the real wage rate and an increase in employment. The rise in employment causes an increase in output, shifting the FE line to the right in Figure 9.23 (b).

To restore equilibrium, the price level must decline, shifting the LM curve down and to the right. Since output increases and the real interest rate declines, consumption and investment increase.

In summary, the real wage, the real interest rate, and the price level decline; and employment, output, consumption, and investment rise.

Figure 9.23

(d) The reduction in the demand for money gives results identical to those in part (b).

2. The increase in the price of oil reduces the marginal product of labor, causing the labor demand curve to shift to the left from ND1 to ND2 in Figure 9.24. Since households’ expected future incomes decline, labor supply increases, shifting the labor supply curve from NS1 to NS2 (but by assumption, the shift to the left in labor demand is larger than the shift to the right in labor supply). At equilibrium, there is a reduced real wage and lower employment. The productivity shock results in a shift to the left of the full-employment line from FE1 to FE2 in Figure 9.25, as both employment and productivity decline. Because the shock is permanent, it reduces future output and reduces the future marginal product of capital, both of which result in a downward shift of the IS curve. The new equilibrium is located at the intersection of the new IS curve and the new FE line. If, as shown in the figure, this intersection lies above and to the left of the original LM curve, the price level will increase and shift the LM curve upward (from LM1 to LM2) to pass through the new equilibrium point. The result is an increase in the price level, but an ambiguous effect on the real interest rate. Since output is lower, consumption is lower. Since the effect on the real interest rate is ambiguous, the effect on saving and investment are ambiguous as well, though the fall in the future marginal product of capital would tend to reduce investment.

Figure 9.24

Figure 9.25

The result is different from that of a temporary supply shock; when the shock is temporary there is no impact on future output or the marginal product of capital, so the IS curve does not shift. In that case the price level increases to shift the LM curve up and to the left from LM1 to LM2 in Figure 9.26 to restore equilibrium. In that case, the real interest rate unambiguously increases. Under a permanent shock, the IS curve shifts down and to the left, so the rise in the real interest rate is less than in the case of a temporary shock, and the real interest rate can even decline.

Figure 9.26

3. (a) The decrease in expected inflation increases real money demand, shifting the LM curve up, as shown in Figure 9.27. The real interest rate rises and output declines.

Figure 9.27

(b) The increase in desired consumption shifts the IS curve up and to the right, as shown in

Figure 9.28. This causes the real interest rate and output to rise.

Figure 9.28

(c) The increase in government purchases shifts the IS curve up and to the right, with the same result as in part (b). (The FE line also shifts, as the increase in government expenditures reduces people’s wealth and leads them to increase labor supply, but this shift will not affect the short-run equilibrium, as the economy will be off the FE line.)

(d) If Ricardian equivalence holds, the increase in taxes has no effect on either the IS or LM curves, so there is no change in either the real interest rate or output. If Ricardian equivalence doesn’t hold, so that the increase in taxes reduces consumption spending, the IS curve shifts down and to the left, as shown in Figure 9.29. Both the real interest rate and output decline.

Figure 9.29

(e) An increase in the expected future marginal productivity of capital shifts the IS curve up and to the right, with the same result as in part (b).

4. The change in Eq. (9.B.10) has no effect on employment, the real wage, or output. The only effect this has is on the term bIS, which is now bIS = [1 – (1 – t)cY – iY]/(cr + ir). The real interest rate and price level are still determined by Eqs. (9.B.22) and (9.B.23), respectively.

5. The change in the money demand function affects only the equation determining the price level,

Eq. (9.B.23). It is now

P = M/[l0 + lY – lr(aIS – bIS + pe – im)]

Inflation refers to a sustained rise in the prices of goods and services. When inflation occurs, the buying value of a currency unit erodes, meaning that a person needs more money to buy the same product. Most economists suggest there is a direct relationship between the amount of money in an economy, known as the money supply, and inflation levels. Understanding the relationship between money supply and inflation is far from easy or predictable, since inflation can easily be influenced by other factors as well.

Money supply and inflation are linked because a high quantity of money usually devalues demand for money. Imagine if everyone in a small town got a $50 US Dollars (USD) raise in salary per month. These people may have been paying $10 USD a week for gasoline, but since their raise was substantial, would now probably not mind paying $11 USD a week for gas, because it is still proportionally less than what they were paying before the raise. This is sometimes how the relationship between inflation and money supply begins, when the market can bear higher prices because money supply has gone up, yet a consumer can't buy a product for the price it was before inflation occurred because the buying power of the currency has eroded.

The relationship between money supply and inflation is explained differently depending on the type of economic theory used. In the quantity of money theory, also called monetarism, the relationship is expressed as MV=PT, or Money Supply x Money Velocity=Price Level x Transactions. The Velocity and Transactions are considered to be constants, so according to this explanation supply and prices have a direct relationship. In Keynesian theory, while there is still a relationship between money supply and inflation, it is not the only large factor that can affect inflation and prices. Generally, the Keynesian theory stresses the relationship between total or aggregate demand and inflationary changes.

Changes in money supply are often used to try and control inflationary conditions. When a region is trying to lower inflation, central banks will generally lower lending rates and increase interest. When inflation drops below a target level, these standards are generally relaxed in an attempt to stimulate the economy. Usually, countries use a federal banking system to set lending and interest limits based on economic data.

Money Supply Definition - Investopedia.com

Money Supply And Demand And Nominal Interest Rates

Unreserved money supply increases can sometimes lead to a condition called hyperinflation. This occurs when inflation jumps extremely high in a short period of time, though the exact definitions are somewhat variable. Economists often say hyperinflation occurs when inflation jumps 50% in a month, but other estimates are also used. Money supply and hyperinflation are linked because the condition can result from a sudden, massive pouring of money into an economy with no associated rise in production or availability of goods. If, in the first example, the townspeople got a raise of $500 USD a month, then the price of gas could suddenly multiply by many times, causing an extraordinarily high level of inflation.

Comments are closed.