- Casino Money Laundering Bc Coronavirus

- Types Of Money Laundering

- Money Laundering Through Casino

- Casino Money Laundering Bc Coronavirus

- Casino Money Laundering Bc 2020

- Gambling And Money Laundering

- Casino Money Laundering Schemes

Former BC Liberal premier Christy Clark told the Commission of Inquiry into Money Laundering in B.C. Tuesday she was never advised her government had raised table bet limits in casinos from $5,000 to $100,000 over the three years following her 2011 designation as premier.

Former British Columbia gaming minister Rich Coleman and senior RCMP officers caused a “tsunami” of casino money laundering, said the province’s former solicit-general, according to a.

Clark asserted she, as premier, had no involvement in the day-to-day activity of Crown corporations such as the BC Lottery Corp. (BCLC), which manages government-regulated casinos.

When asked by commission counsel if she would have been surprised to hear of this change, while in office, Clark replied: “I don’t gamble, so I don’t know what’s normal in a casino.”

Clark was called to the commission to explain her role in regulating casinos.

At issue is whether Clark’s government, between 2011 and 2017, could have wilfully ignored money-laundering concerns – mentioned publicly and internal to BCLC – in order to augment provincial revenue.

Casino Money Laundering Bc Coronavirus

“What government does is always having to balance revenue concerns against other issues,” Clark said. She added, however, “Never did we say revenue considerations would come before stopping criminal activity.”

Although stating she generally delegated responsibilities to cabinet ministers in charge of BCLC, Clark did cite some specific examples of government action to address those concerns, such as cash sourcing, banning gamblers and digital gambling accounts, which were considered novel to the gambling industry at the time.

Clark was most specific about establishing an RCMP task force called the Joint Illegal Gaming Investigation Team (JIGIT), which she initially said formed in 2015 but was later corrected by B.C. government lawyer Jacqueline Hughes that, in fact, it was created in 2016.

Commissioner Austin Cullen runs the public inquiry and senior commission counsel Patrick McGowan conducted the two-hour examination of Clark, who spoke alongside her lawyer Robert Cooper of McEwan Cooper Dennis LLP.

The commission has never acknowledged receipt of cabinet documents from the BC Liberals, the release of which were a matter of public scrutiny before the inquiry launched.

Types Of Money Laundering

Under Clark, three ministers controlled BCLC under their ministries – first Shirley Bond, then Rich Coleman and finally Michael de Jong. All three will testify by the end of the month.

Asked by McGowan what steps she took to address money laundering concerns widely cited in media back in 2011, Clark said a casino money laundering report (the ‘Kroeker Report’) was commissioned before her designation as premier in 2011 and landed on Bond’s desk shortly thereafter.

Clark said she was aware of those early media reports but took no steps to verify the claims.

“Yes, money laundering is an issue in B.C., no question about it. That’s why we commissioned the Kroeker Report,” she said.

Clark initially said JIGIT was created in “short order,” but McGowan pointed out the gap in years between the Kroeker Report and JIGIT’s establishment.

“When you’re involving the RCMP… it took a little bit of time to put all that together,” replied Clark, adding, “I wouldn’t accept the assumption it was delayed.”

Clark said government does not control the daily operations of the RCMP.

“The daily work of law enforcement was something I wasn’t engaged in.”

Clark was premier during a time, the commission has heard, that saw a significant rise in large and suspicious casino transactions allegedly linked to transnational organized crime. Between 2011 and 2015, the inquiry has heard of a gap in RCMP enforcement on the issue. The provincial government is supposed to chart a path for the provincially dedicated police force from Ottawa.

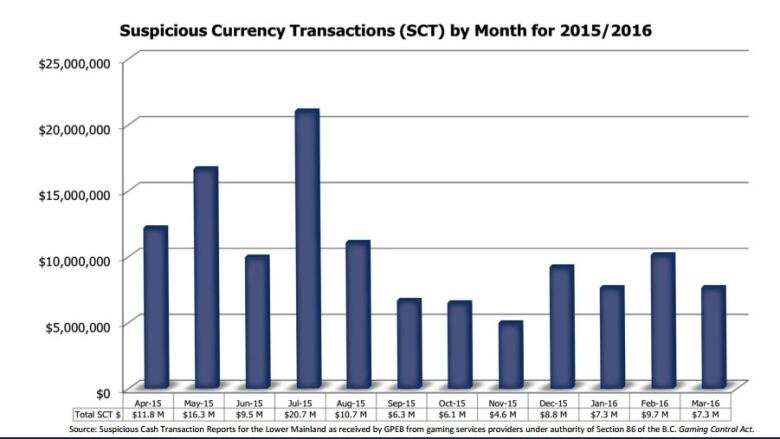

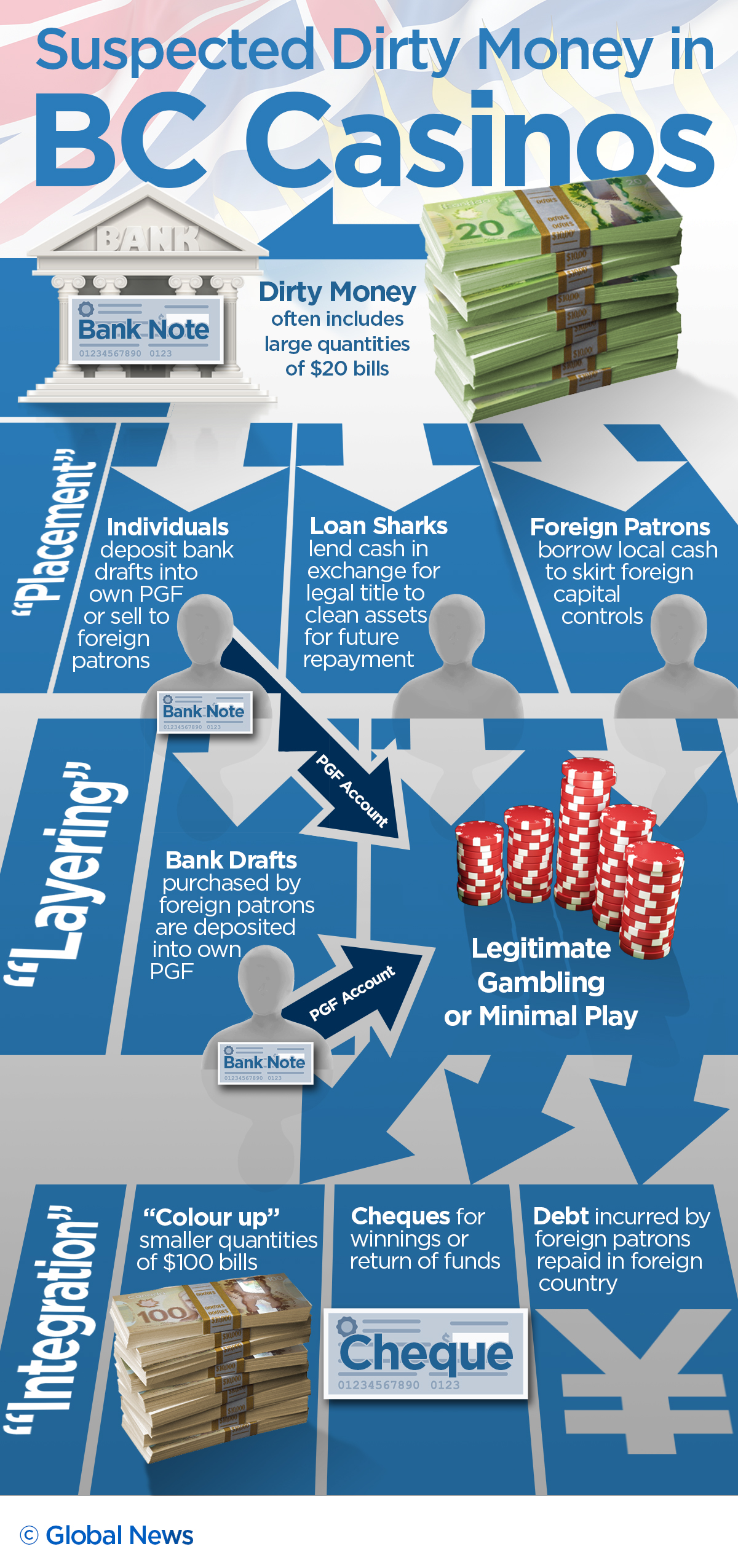

The commission has heard of how it became routine for suspected loan sharks and organized criminals to be funding Chinese gamblers exclusively with bags of $20 bills worth hundreds of thousands of dollars. This amounted to tens of millions of dollars worth of suspicious cash transactions being reported monthly by casinos, although for years they excluded buy-ins under $50,000, in apparent violation of federal law.

Clark said she was unaware of organizational friction between regulator Gaming Policy and Enforcement Branch (GPEB) and BCLC. McGowan raised the spectre of a conflict of interest Clark set by having the same ministry oversee both BCLC and GPEB.

Clark said it was only two weeks ahead of JIGIT’s launch in April 2016 that she was briefed on a spike in suspicious transactions. By this time the RCMP was a year into an investigation into transnational organized crime, called E-Pirate.

“It was the first time I heard about it from within government,” said Clark, meaning she wasn’t briefed on extensive reporting from GPEB casino investigators who had been warning that suspected drug cash was making its way through casinos since 2008.

“Did you ask whether this money that was reported as suspicious was accepted by casinos ... or whether it was refused?” McGowan asked. “Did you make that inquiry?”

“I didn’t,” Clark said. “What we did instead was create JIGIT.”

McGowan asked Clark for her opinion on taking campaign donations from casinos to fund her election and whether it was a conflict of interest given she was regulating them. She replied that doing so was no different than taking money from other industries. (In 2018 the BC NDP banned corporate donations).

Clark also oversaw an era of skyrocketing housing prices unique to Metro Vancouver – another matter the provincial inquiry is looking into.

“I can say no one … from anywhere in government or law enforcement ever suggested [the] rise in housing prices was the result of money laundering,” replied Clark.

She said low interest rates, job growth and immigration were the key reasons for Vancouver’s unique rise in housing prices between 2015 and 2017.

“I’d be careful drawing the conclusion money laundering would be the source of that growth,” said Clark, who took government on trade missions of China that included promotion of real estate.

Clark said her government implemented the foreign buyer’s tax and ended self-regulation of the real estate industry – what she then called “shady” practices, such as shadow flipping by realtors. She said her government charted a path for the B.C. speculation and vacancy tax, which she added was a good idea.

Clark’s testimony ran just over two hours. Inquiry participant BCLC posed no questions to Clark.

Near the end, Transparency International Canada questioned Clark on her views on hidden beneficial ownership structures.

“It was something government had talked about,” said Clark, adding those discussions may have assisted the BC NDP in its work in creating a beneficial property ownership registry.

The inquiry has heard from financial crime experts on how beneficial ownership structures can obscure foreign ownership of land in Canada and benefit both local and international criminals intending to wash proceeds of crime through real estate.

The inquiry is mandated to make recommendations for provincial regulators, such as BCLC and GPEB, as well as the regulation of real estate and luxury goods. It is not a federal inquiry and has limited insight into federally regulated financial institutions, which are known to facilitate the bulk of global money laundering.

The inquiry has heard testimony from ex-RCMP officers that money laundering in B.C. is a threat to national security, although the inquiry has not explored this aspect.

B.C.’s Civil Forfeiture Office is suing two men for more than $70,000 and a vehicle as proceeds of alleged money laundering | Duc Dao

While debate continues over the effectiveness of efforts to eliminate money laundering through B.C. casinos, recent court documents filed by the province’s director of civil forfeiture suggest gambling facilities continue to be targeted by those looking to protect their ill-gotten gains.

The BC Lottery Corp. (BCLC) declined a request to be interviewed about the case, but stated in an email that it is “deeply concerned” by the allegations in the claim.

“It is completely unacceptable to BCLC that our facilities be used in any way to launder money. BCLC is not aware of all details or extent of the evidence the CFO [Civil Forfeiture Office] intends to use to prove its case. However, we are using the information we do have about the case to review our money-laundering countermeasures.”

Filed in BC Supreme Court on January 15, the director’s notice of civil claim names Michael John Mancini and Gerald John Collins and seeks forfeiture of $70,800 and a 2014 Chevrolet Camaro stemming from an incident last year.

On October 5, 2015, RCMP received reports of an erratic driver on Highway 1 travelling west toward Chilliwack, according to the lawsuit. Police later found the car at Chances casino on Young Road parked in a handicap spot with its interior lights still on as Mancini was walking toward the casino.

When the RCMP confronted Mancini, he was allegedly holding $3,775 in cash and “reported to RCMP spontaneously that he had won $300,000 playing slot machines at various casinos throughout British Columbia since March 2015,” the claim states.

In addition to the cash, the director claims, Mancini showed police a cheque for $13,250 made out to him from Lake City Casino. Police impounded the vehicle after Mancini allegedly failed a sobriety test. Police seized the vehicle and $45,395 as “offence-related property and proceeds of crime,” the lawsuit states.

A subsequent search of the vehicle on December 15, 2015 – this time with a warrant – turned up $25,405 in cash in addition to crack cocaine, several unspecified pills and prohibited radar detection equipment.

“Subsequent RCMP investigation determined that Mr. Mancini had actually been paid approximately $2,189,880 by British Columbia casinos between November 24, 2014, and October 11, 2015,” the claim states. “Mr. Mancini was attending casinos for the sole purpose of laundering the money.”

Money Laundering Through Casino

Collins was allegedly selling Mancini the vehicle at the time. In a response filed February 12, Collins and Mancini deny using the car for unlawful activity and claim the search was conducted without a warrant. In addition, the response notes that Mancini “was not charged with any criminal offence arising from the driving on that date nor from his possession of the money.”

“Mancini denies attending casinos for the purpose of laundering money,” the response states. “Mancini frequently attends casinos throughout British Columbia and is a legitimate and bona fide gambler. He won substantial amounts of money during 2014 and 2015 from entirely lawful gambling activities.”

The pair’s lawyer, Donald Muldoon, did not respond to requests for comment. Representatives from both the RCMP and the Civil Forfeiture Office declined to comment on the case, but the forfeiture office stated in an email that “any individual who claims an interest in property subject to civil forfeiture proceedings has an opportunity to tell their side of the story to a judge.”

Casino Money Laundering Bc Coronavirus

For its part, the Financial Transactions and Reports Analysis Centre of Canada, known as Fintrac, received 1,508 “suspicious transaction reports” from B.C. casinos in 2015 and more than 36,000 “large cash transaction reports” that same year, according to Fintrac spokesman Darren Gibb.

However, Gibb said, the regulator is under tight restrictions about what information can be publicly revealed, admitting that Fintrac “cannot disclose whether or not a B.C. casino has been issued a penalty.”

Gateway Casinos, operator of Lake City Casinos, declined to comment about the lawsuit.

“As this matter is currently before the courts, and the particulars of the case have yet to be fully revealed, it would be inappropriate for us to comment. However, all Gateway Casino locations adhere to all policies and procedures for anti-money-laundering programs that are set out by our regulators,” Gateway public relations director Tanya Gabara said in an email.

The director of civil forfeiture seeks to seize the vehicle and $70,800 as proceeds of unlawful activity from the defendants. The allegations have not been tested or proven in court.

Casino Money Laundering Bc 2020

news@biv.com

Gambling And Money Laundering

Casino Money Laundering Schemes

@bizinvancouver

Comments are closed.